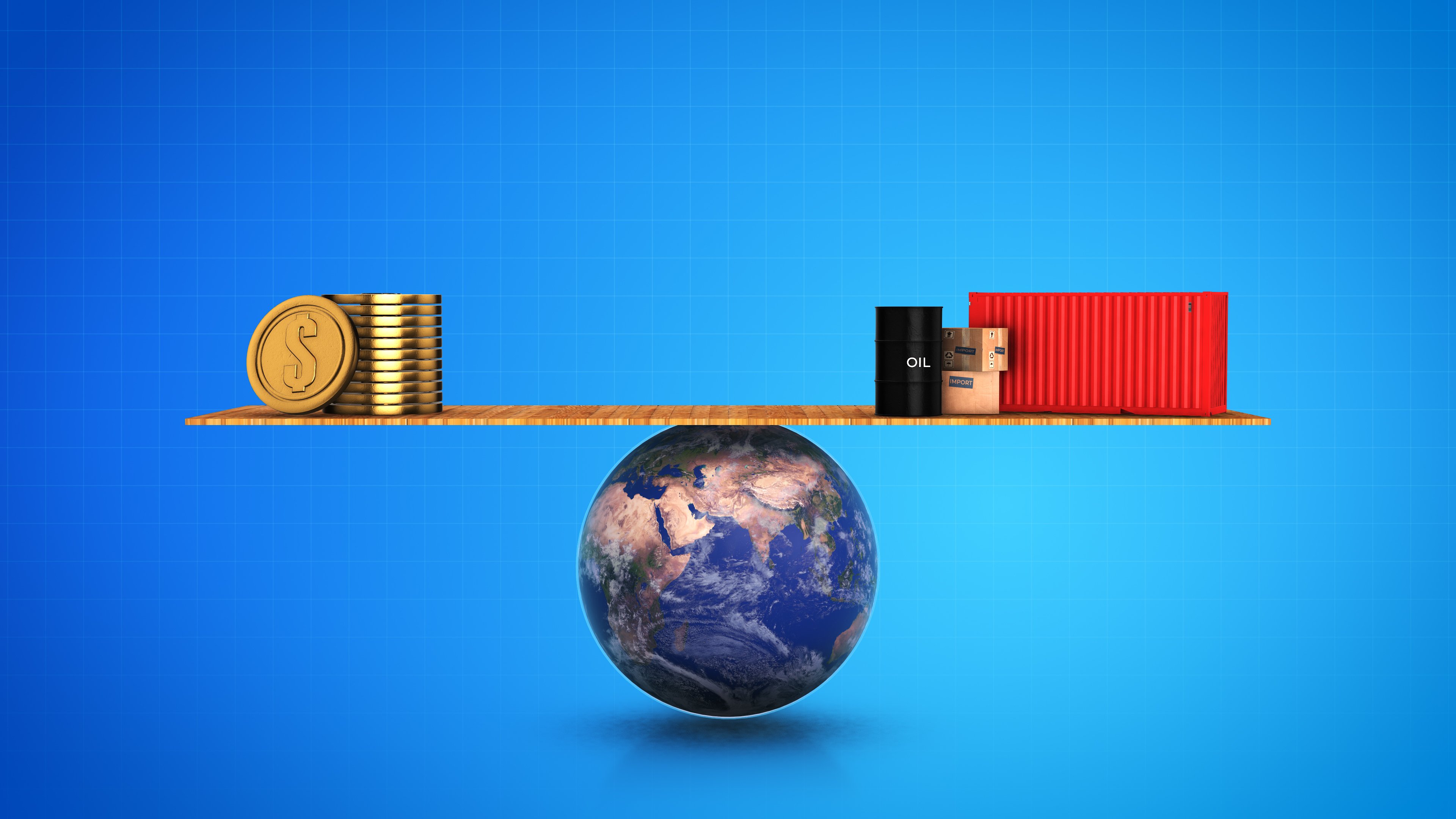

Section 321 of the U.S. Tariff Act has long provided shippers with a significant cost-saving opportunity, allowing low-value shipments (valued under $800) to enter the U.S. duty-free. This exemption has been widely used by e-commerce businesses, cross-border retailers, and logistics providers to streamline imports and reduce costs.

President Trump signed an executive order to suspend Section 321 of the US customs code on February 1, 2025, and it took effect on February 4, 2025. This suspension halted the duty-free entry process for shipments under $800. This guide will help businesses understand the Impact of the Section 321 suspension, what It means for supply chains, and how to navigate the changes effectively. This guide will help businesses understand the impact of the Section 321 suspension, what it means for supply chains, and how to navigate the changes effectively.

What Changed on February 1, 2025?

The Suspension of Section 321

The U.S. government has temporarily halted the Section 321 de minimis exemption due to concerns about compliance, fraud prevention, and broader trade policy shifts. This means that all shipments—regardless of value—are now subject to standard customs duties and regulations.

Why Was Section 321 Suspended?

Several factors led to this decision, including:

- Concerns Over Compliance and Fraud – A rise in companies exploiting the exemption to avoid duties raised alarms within regulatory agencies.

- Trade Policy Adjustments – Policymakers aimed to tighten import controls and ensure a fair competitive landscape for domestic businesses.

- Security and Supply Chain Transparency – The government seeks greater visibility into shipments to prevent illicit trade and ensure safety.

Immediate Impact on Shippers

The suspension of Section 321 has significant consequences for shippers, particularly those reliant on duty-free imports.

Higher Import Costs

Without Section 321, shipments valued under $800 are now subject to duties and tariffs, increasing the overall cost of doing business. Companies must factor in these additional expenses when pricing products and planning logistics.

Customs Clearance Delays

Shipments that previously moved swiftly under Section 321 now require full customs processing, leading to potential delays at ports of entry. Businesses must adjust fulfillment timelines to account for longer clearance times.

Increased Compliance and Documentation Requirements

Shippers must now adhere to stricter regulatory requirements, including proper classification, valuation, and record-keeping. Failure to comply could result in penalties, shipment holds, or other disruptions.

Key Considerations for Shippers

Regulatory Compliance

To avoid costly penalties, businesses must ensure full compliance with updated customs regulations. Proper documentation, including invoices, HS codes, and country-of-origin details, will be critical to smooth operations.

Cost Implications and Mitigation Strategies

With duties now applied to all shipments, businesses need strategies to minimize cost increases, including:

- Consolidating shipments to optimize freight costs.

- Exploring duty drawback programs or bonded warehousing solutions.

- Adjusting pricing models to account for added expenses.

- Potential reviewing distribution network within domestic US to optimize fulfillment speed and cost economics

Operational Challenges

Cross-border e-commerce and supply chain management will become more complex. Companies must rethink inventory distribution, order fulfillment processes, and warehouse locations to adapt to the new rules.

How ODW Logistics Can Help Shippers Adapt

Partnering with an experienced logistics provider like ODW Logistics can help businesses navigate the new regulatory landscape and optimize supply chain operations.

Network Studies to Select the Best Domestic Solution

ODW employs specialized software to analyze and determine the most efficient distribution nodes for brands. This analysis considers factors such as import origins, domestic manufacturing sites, and product category specifics. Our team utilizes this software to model optimal locations, incorporating critical customer constraints like delivery speed, service level agreements, and unique product requirements.

Compliance Support

ODW offers expert guidance on customs regulations, ensuring all documentation is accurate and shipments remain compliant to avoid costly delays.

Freight Consolidation & Duty Optimization

Our team helps businesses find cost-effective shipping solutions, including:

- Consolidating shipments to minimize customs fees.

- Utilizing Foreign Trade Zones (FTZs) and bonded warehouses.

- Identifying alternative shipping routes to reduce expenses.

Enhanced Distribution Strategies

With a nationwide network of distribution centers, ODW Logistics helps businesses restructure fulfillment strategies to maintain efficiency. Nearshoring options and diversified supply chain strategies can also mitigate risks associated with the policy change.

Technology & Data-Driven Insights

ODW leverages advanced Warehouse Management Systems (WMS) and Transportation Management Systems (TMS) to provide real-time tracking, cost-saving insights, and greater operational efficiency for shippers adjusting to the new import landscape.

Next Steps for Shippers

To minimize disruption and maintain efficiency, businesses should take immediate action:

- Review and adjust import strategies to account for the loss of duty-free exemptions.

- Work with a logistics partner to explore cost-saving alternatives such as freight consolidation and bonded warehousing.

- Stay informed on trade policy changes to anticipate further regulatory shifts that may impact shipping and distribution.

Get Expert Guidance from ODW Logistics

Navigating the suspension of Section 321 requires strategic planning and expert support. ODW Logistics provides customized solutions to help shippers optimize costs, streamline operations, and maintain compliance.

Contact us today for a consultation and learn how we can help your business adapt to the new import regulations.

%20(1)-1.png?width=2000&height=500&name=ODW%20HH%20Landing%20Pages%20Headers%20(1200%20x%20300%20px)%20(1)-1.png)