Shippers are bracing for sustained high spot truckload pricing and increases in contract rates as their business comes up for bid over the next few months and in early 2021.

Shippers whose budgets have been blown into the stratosphere this summer and fall are not going to recoup those expenses easily, and will have to make tough decisions about what they will do to try to bring costs back into line in 2021, logistics executives said. That effort may involve even more collaboration than was discussed back in the tight market of 2018.

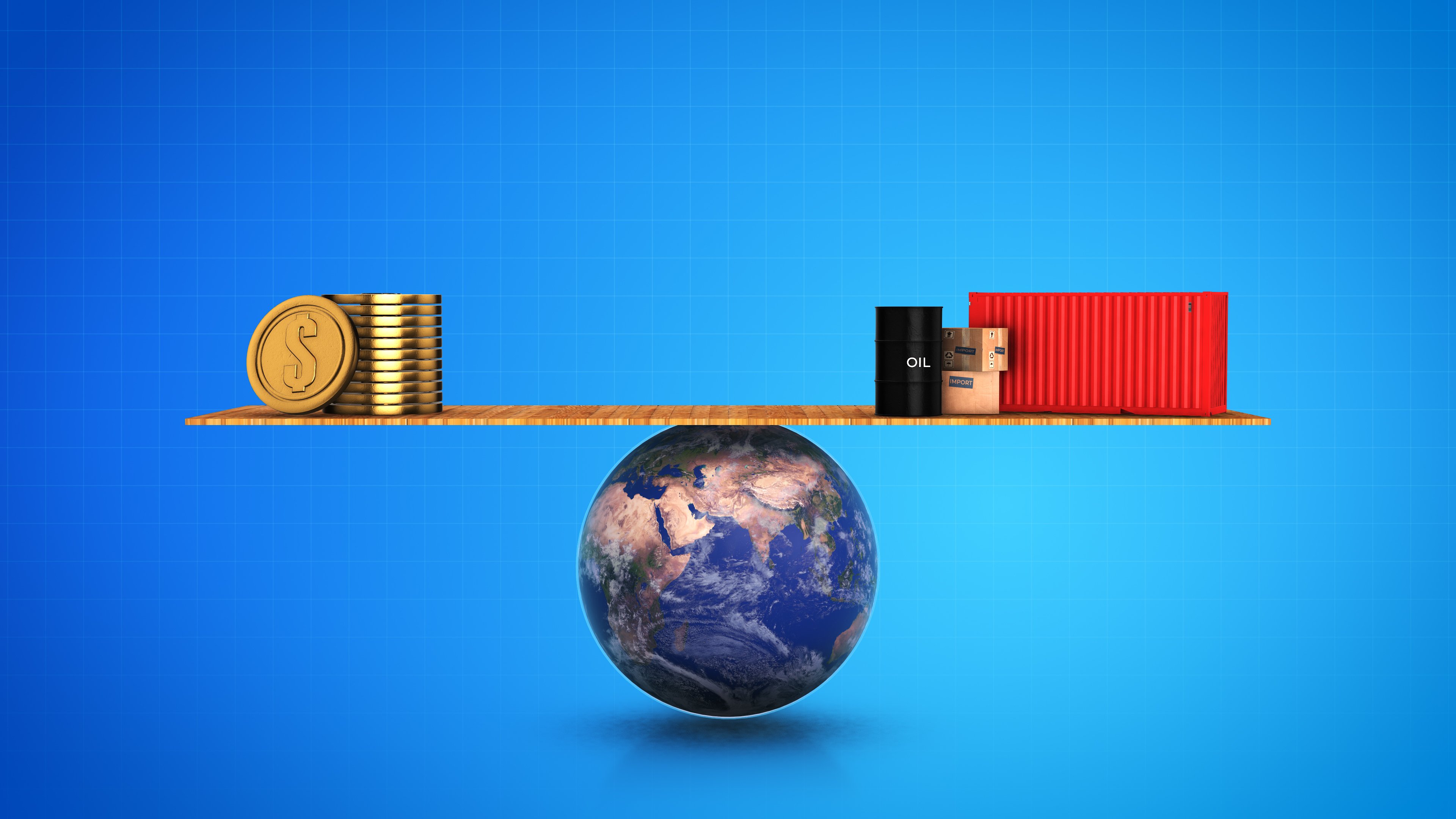

After rising for months, the national average dry van spot rate hit a record high of $2.46 per mile in the week ended Oct. 4, according to DAT Freight & Analytics. The average outbound van rate from Los Angeles, the busiest outbound spot market, rose $0.07 over the previous week to $3.37 a mile, propelled by high volumes of containerized imports coming through the ports of Los Angeles and Long Beach.

That $2.46 per mile national average is up 54 percent from $1.60 per mile in May, according to DAT’s data. Excluding fuel surcharges, the DAT average dry van rate for the first week ending in October was $2.19 per mile. In early May, that weekly average rate had been as low as $1.34 per mile. The pricing yardstick has risen 58 percent over 20 weeks.

Heading into orbit

Can spot rates go much higher? Logistics executives said they are not sure, but they do not expect truckload rates to fall back.

“We’re back to 2018-type levels as far as capacity goes,” Dave Giblin, vice president of ODW Logistics in Columbus, Ohio, said Wednesday. “Every week is different, you don’t know what to expect. I don’t see that changing for the next six months, at least.”

Supply chains and trucking networks were thrown into disorder when the COVID-19 pandemic first struck the US and are still recovering. They are being kept off-kilter by the continued spread of COVID-19, which is not giving supply networks a chance to rebalance and find a ‘new normal’. Capacity constraints are stoking prices and keeping supply chains near boiling temperatures.

In some cases, shippers have simply decided to keep at least some freight out of the pot, Giblin said in an interview. “They’ve elected to not ship at a 30 to 40 percent elevated freight cost, and only to ship what has to go,” he said. “Here we are in the fourth quarter, and it’s not going to get better in the next three months. That’s requiring a mental shift” among logistics managers.

“Some of the backlogs medium-sized shippers are working through are so big they’ve been able to use them as leverage,” Giblin said. “They’re using that excess volume to act like much bigger shippers and distribute to smaller locations to widen their capacity options for delivery,” something companies with smaller freight volumes are not typically able to do.

Tightening the screws

Truckload capacity continues to tighten in October, dropping 1.5 percent week over week on the spot market in the first week of the month, according to DAT. In September, the number of spot loads posted to DAT’s load boards increased 116 percent and truck posts dropped 6.2 percent year over year. That drove outbound spot truckload rates up across several regions.

In Allentown, Pennsylvania, the site of many major warehousing and fulfillment centers serving consumer markets in the Northeast, outbound dry van spot rates jumped 19 cents to $2.92 per mile in the week ended Oct. 4, DAT said. Average dry van rates out of Columbus, Ohio, were up 8 cents to $3.19 per mile, and outbound Memphis rates rose 9 cents to $2.94 per mile on average.

Source: WIlliam B. Cassidy - JOC