Why a TMS Is Not Enough: Signs You Need Enterprise Managed Transportation

A Transportation Management System, or TMS, is often one of the first major technology investments a growing shipper makes. At its best, a TMS helps plan loads, tender freight, rate shop, and track shipments. For many organizations, it brings order to what was once a manual, spreadsheet-driven process.

But as networks grow more complex, many logistics leaders discover an uncomfortable truth. The TMS that once felt like a solution now feels like a ceiling.

Enterprise Managed Transportation is the next evolution. It unlocks the ecosystem; beyond adding people, managed transportation enables a broader network of optimization, rating, forecasting, visibility, and analytics tools that no single TMS can realistically keep current. These microservices only create value when they are actively managed, tuned, and operationalized.

This article breaks down what a TMS can and cannot do, the most common signs it has reached its limits, and how Enterprise Managed Transportation fills the gaps.

What a TMS Can and Cannot Do

A modern TMS is designed to support execution. Most platforms handle a similar set of core functions:

- Load planning and tendering

- Rate management and carrier selection

- Shipment tracking and status updates

- Freight audit support and reporting

These capabilities are valuable. They bring structure and consistency to day-to-day transportation tasks. But where a TMS struggles is in areas that require judgment, cross-functional coordination, and continuous optimization. Common limitations include:

- Limited predictive insight into future disruptions or cost trends

- Reactive exception management that depends on human intervention

- Optimization that is rule-based rather than network-aware

- Fragmented visibility when data lives across multiple systems

A simple analogy helps: a TMS is like a navigation app. It can show routes and estimate costs, but it does not manage traffic, negotiate road access, or reroute your business when conditions fundamentally change. Someone still has to drive.

What a TMS can do

- Execute shipments based on defined rules

- Centralize basic transportation data

- Support transactional efficiency

What a TMS cannot do

- Proactively manage carriers and performance

- Continuously optimize a complex network

- Replace strategic transportation expertise

Optimization is harder than most TMS narratives imply; true optimization goes beyond rules and execution. Driving meaningful outcomes, especially reducing and refining LTL, requires order-level planning, multi-day tradeoffs, and constant adjustment that is difficult to sustain in a TMS-only environment.

9 Clear Signs Your TMS Has Reached Its Limits

Many organizations do not realize they have outgrown their TMS until problems become persistent. These are the most common signals.

- Planning is reactive, not predictive. Loads are planned day by day with little foresight. Fire drills replace strategy, especially during peak seasons or disruptions.

- Freight spend keeps rising with no clear explanation. You see the total cost, but not the drivers behind it. Lane volatility, accessorial creep, and poor mode decisions go unchecked.

- Manual overrides are the norm. Planners constantly work around the system. Spreadsheets, emails, and phone calls fill the gaps the TMS cannot handle.

- Data lives in too many places. Transportation data, warehouse data, and order data do not align. Reporting varies depending on the source, which erodes trust in insights.

- Carrier performance is hard to measure or enforce. On-time performance, tender acceptance, and service failures are visible only after the fact, if at all.

- The system cannot scale with growth. New customers, regions, or modes introduce complexity the TMS was not designed to handle without major reconfiguration.

- Compliance and risk are blind spots. Carrier insurance, safety scores, and regulatory requirements are tracked inconsistently or manually.

- Automation stalls at basic workflows. Beyond tendering and tracking, processes remain manual. Exception handling and continuous improvement depend on a few key people.

- Customer service escalations increase. Late shipments and missed appointments reach customers before they reach your team. Transportation issues become a customer experience problem.

Why Enterprises Outgrow a TMS Faster

Growth does not just add volume. It adds complexity.

Multi-region networks introduce varying carrier markets, regulations, and service expectations. Order profiles change as customers demand tighter delivery windows and more visibility. Carrier portfolios expand, making performance management harder. Service level agreements become stricter and less forgiving.

A TMS was never intended to own all of that complexity. It supports execution, but it does not manage the ecosystem around it.

Enterprise Managed Transportation: The Strategic Upgrade

Enterprise Managed Transportation combines technology, process, and people into a single operating model. Instead of simply using a TMS, shippers gain a team that actively manages transportation on their behalf.

At ODW Logistics, this approach includes:

- Dedicated transportation professionals who oversee daily execution and long-term strategy

- Advanced optimization and analytics layered on top of TMS technology

- Active carrier management, procurement support, and performance governance

- Continuous improvement focused on cost, service, and scalability

Rather than replacing a TMS outright, managed transportation often complements it. The technology remains the backbone, while experts interpret data, manage exceptions, and drive optimization that software alone cannot deliver.

Results come from management, not just software. Sustained LTL avoidance and consolidation outcomes typically require a broader management model that coordinates technology, data, carriers, and daily decisions, not just a platform executing predefined logic. The result is proactive control instead of reactive firefighting.

How to Evaluate If You Are Ready for Managed Transportation

A simple self-assessment can clarify readiness. Consider the following questions:

- Are transportation decisions driven by data or by urgency?

- Can you clearly explain what is driving freight cost changes?

- How much time do planners spend managing exceptions versus improving the network?

- Can your current model scale if volume increases by 20 percent?

Organizations typically see strong ROI from managed transportation when freight spend is large enough to justify optimization, when internal teams are stretched thin, or when service failures begin to impact customers.

Modeling the business impact often reveals that savings come not just from lower rates, but from better mode selection, improved carrier performance, and fewer disruptions.

Conclusion

A TMS is an essential tool, but it is not a complete transportation strategy. When visibility is limited, costs rise without explanation, and teams spend more time reacting than improving, it is a sign the system has reached its limits.

Enterprise Managed Transportation provides the structure, expertise, and accountability needed to manage complex networks at scale.

If you recognize these signs, the next step is understanding what a managed model could deliver for your business. ODW Logistics offers an Enterprise Managed Transportation approach designed to help shippers regain control, reduce risk, and support growth.

Assess your readiness and explore whether managed transportation is the right next step.

FAQs

What happens when a TMS is not enough?

When a TMS is stretched beyond its design, organizations rely heavily on manual workarounds. Costs increase, service suffers, and transportation becomes a bottleneck rather than a competitive advantage.

How do you know if you need managed transportation?

Common indicators include rising freight spend, limited visibility into performance, frequent exceptions, and difficulty scaling with growth.

What is the difference between a TMS and managed transportation?

A TMS is a technology platform for executing shipments. Managed transportation is an operating model that combines technology with experienced professionals who actively manage carriers, costs, and performance across the network.

Signs You’ve Outgrown In-House Transportation Management

In-house transportation management is often the default starting point for growing companies. You build a small team, implement a TMS, and manage carriers directly. Early on, this approach offers control, familiarity, and the sense that transportation is being handled close to the business.

Over time, though, scale changes the equation. Volumes increase, customer expectations tighten, and networks expand across regions and modes. What once worked efficiently can quietly turn into a constraint.

This article explains what in-house transportation management typically looks like, the warning signs that it is no longer sustainable, and what enterprise shippers replace it with when growth outpaces internal resources.

What Does In-House Transportation Management Look Like?

In-house transportation management means your organization owns execution and oversight of freight operations internally. This usually includes:

- Transportation planners and coordinators managing daily loads

- Direct carrier relationships and rate negotiations

- KPI tracking, reporting, and issue resolution

- Compliance, claims, and freight audit support

The typical technology stack combines a TMS with spreadsheets, email, and manual workflows. While the TMS handles tendering and tracking, planners fill in the gaps by managing exceptions, reconciling data, and communicating across teams.

This model is appealing early on. It offers visibility, perceived cost control, and the ability to make quick decisions without involving external partners. The challenge is that it scales linearly. As freight volume and complexity grow, headcount and effort must grow with it.

In-house transportation management

A model where a company uses its own internal team and technology to plan, execute, and manage transportation operations, including carriers, costs, and service performance.

8 Indicators You’ve Outgrown In-House Transportation

Certain patterns appear consistently when internal teams reach their limits.

- Persistent labor overload and burnout. Planners spend most of their time reacting to issues instead of improving processes. Coverage becomes fragile, especially during peak seasons or absences.

- Limited real-time shipment visibility. Tracking exists, but it is fragmented. Issues are discovered after delays occur, often by customer service or customers themselves.

- Disparate data and weak analytics. Transportation data lives in multiple systems. Reporting is slow, inconsistent, and difficult to trust for decision-making.

- Rising carrier costs with little leverage. Rates increase faster than volume. Spot buys become common, and negotiation power is limited without broader market insight.

- Missed KPIs and service failures. On-time delivery (OTIF) and appointment compliance slip as networks become more complex and harder to manage manually.

- Inefficient route and mode planning. Loads are planned shipment by shipment instead of optimized across lanes, regions, or modes.

- Slow dispute and claim resolution. Freight disputes linger due to limited bandwidth and inconsistent documentation, tying up cash and time.

- Growth stretches resources thin. New customers, regions, or service offerings expose gaps that internal teams cannot fill quickly enough.

The Cost of Holding On to In-House Transportation

Many organizations underestimate the true cost of keeping transportation fully in-house.

Hidden costs include excess labor, expedited freight, and missed optimization opportunities. Penalty fees, service credits, and customer churn increase when service reliability suffers. Strategic initiatives stall because experienced team members are consumed by day-to-day execution.

The biggest cost is often the opportunity cost. When transportation absorbs leadership attention, growth initiatives, network redesigns, and customer expansion slow down.

What Enterprises Replace In-House Teams With

As complexity increases, many enterprises transition to Enterprise Managed Transportation Services.

Managed transportation shifts responsibility for execution, optimization, and continuous improvement to a specialized partner. At ODW Logistics, this includes:

- Dedicated transportation professionals managing daily operations

- Technology-enabled visibility and analytics layered on top of TMS platforms

- Active carrier management, procurement support, and performance governance

- Continuous improvement focused on cost control, service, and scalability

This model does not eliminate technology; it elevates it. A TMS remains the system of record, while managed transportation adds expertise, process discipline, and accountability that internal teams struggle to maintain at scale.

How to Decide: Maintain In-House or Outsource

The decision comes down to risk, cost, and focus. If transportation performance depends heavily on a few key individuals, risk is high. If costs rise faster than volume and service metrics decline, the model is under strain. If leadership spends more time fixing freight issues than growing the business, focus has shifted.

A structured evaluation should include operational risk assessment, cost modeling, and a clear implementation roadmap. Many organizations start with partial outsourcing, then expand as confidence and results grow.

Conclusion

In-house transportation management can work well at a smaller scale. But when growth accelerates, complexity increases, and teams struggle to keep up, it becomes a limiting factor.

Recognizing the signs early allows organizations to transition before service and costs suffer further. Enterprise Managed Transportation offers a scalable alternative that combines technology, expertise, and proactive management.

If these challenges sound familiar, the next step is a conversation. Talk with an expert at ODW Logistics to explore whether managed transportation is the right fit for your network and growth plans.

FAQs

When should a company outsource transportation management?

Outsourcing makes sense when internal teams are overloaded, costs lack transparency, or service performance becomes inconsistent as the network grows.

Is in-house transportation management scalable?

It can scale to a point, but growth usually requires proportional increases in staff and effort, which limits efficiency and flexibility.

What are the pros and cons of in-house vs. outsourced transportation?

In-house management offers control and familiarity early on. Outsourced managed transportation provides scalability, expertise, and continuous optimization as complexity increases.

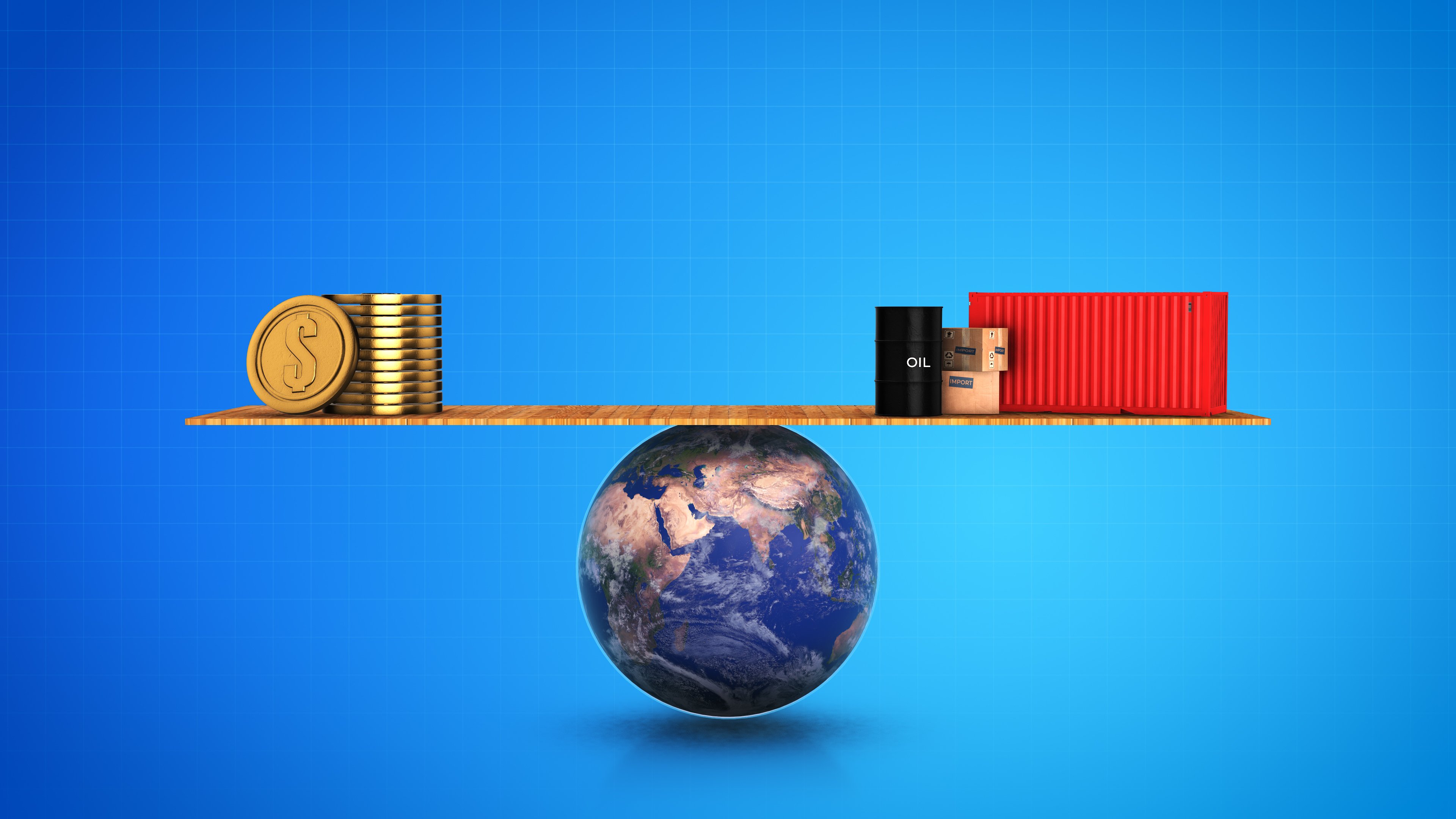

Why Transportation Cost Volatility Breaks Annual Freight Budgets and How Managed Transportation Stabilizes It

Most transportation budgets are built once a year and expected to hold steady. In reality, freight costs rarely cooperate. Fuel swings, shifting capacity, and market disruptions can turn a well-planned budget into a moving target within months.

High transportation costs are challenging, but volatility is often more damaging. When costs fluctuate unpredictably, forecasting breaks down, service suffers, and leadership loses confidence in the numbers. Stability, not just savings, becomes the real goal.

Managed Transportation offers a way to bring structure and predictability back to freight budgets by combining analytics, carrier strategy, and proactive execution.

What Drives Transportation Cost Volatility

Freight costs fluctuate for a reason. Several forces move simultaneously, often amplifying one another.

- Fuel price fluctuations directly impact linehaul and accessorial costs. Even small changes ripple across the network.

- Capacity swings occur as supply and demand shift. Tight capacity during peak seasons or disruptions drives rates up quickly, while soft markets can mask underlying inefficiencies.

- Seasonal demand adds pressure. Retail peaks, produce seasons, and weather events create short-term surges that strain carrier networks.

- Carrier rate volatility reflects changing operating costs, driver availability, and network imbalances. Annual rate cards rarely account for these dynamics.

- Geopolitical disruptions, from port congestion to global conflicts, introduce uncertainty that can reshape lanes and costs with little warning.

Individually, these factors are manageable. Together, they create a level of unpredictability that static budgets cannot absorb.

How Volatility Breaks Annual Freight Budgets

Annual freight budgets depend on assumptions that rarely hold for long. When volatility hits, forecasts miss the mark early. Supply chain disruptions force last-minute mode shifts or expedited shipments, driving unplanned spend. Budget overruns follow, often without clear attribution to root causes.

As costs fluctuate, visibility declines. Finance and operations see totals but struggle to understand trends, making mid-year corrections difficult. The result is a reactive cycle where transportation becomes a budget risk rather than a controlled expense.

Traditional Cost Control Methods and Why They Fail

Many organizations rely on familiar tactics to manage transportation costs, but these approaches are ill-suited for volatile markets.

- Static contracts lock in rates that may not reflect real-time conditions. They can protect against spikes in some lanes while creating overpayment in others.

- Manual budgeting relies on historical averages that ignore market dynamics. By the time variance is detected, the damage is done.

- Overreliance on the spot market exposes shippers to the most volatile pricing available, especially during capacity crunches.

- Basic TMS planning focuses on execution, not scenario modeling or predictive insight. It reacts to volatility instead of anticipating it.

These methods control pieces of the problem, but not the system as a whole.

Managed Transportation as a Stabilizer

Managed Transportation approaches cost control as an ongoing process rather than an annual exercise. Advanced forecasting and analytics identify trends before they impact budgets. Instead of reacting to cost increases, teams model scenarios and adjust strategies proactively. Rate management and carrier portfolio optimization spread risk across a balanced mix of contract, core, and backup carriers. This reduces exposure to sudden market shifts. Dynamic planning evaluates mode, route, and carrier decisions continuously, not just at bid time. Scenario modeling helps teams understand the budget impact of volume changes or disruptions. Risk mitigation processes address exceptions quickly, preventing small issues from becoming expensive problems.

The benefits extend beyond savings. Organizations gain more predictable monthly budget outcomes, stronger negotiation leverage with carriers, lower volatility in freight spend, and improved adherence to service commitments.

At ODW Logistics, managed transportation combines these capabilities with dedicated transportation professionals who actively manage cost and service across the network.

Case Examples and Outcomes

Shippers using managed transportation often see meaningful improvements in budget stability. Year-over-year freight cost variation narrows, even in volatile markets. Forecast accuracy improves as data quality and modeling mature.

More importantly, leadership gains confidence that transportation budgets reflect reality, not best-case assumptions.

How to Start Stabilizing Your Freight Costs

Stabilization begins with structure. A typical path includes:

- Baseline current freight spend and volatility by lane and mode

- Define budget accuracy and service KPIs

- Integrate transportation data across systems

- Optimize carrier portfolios and rate strategies

- Implement forecasting and scenario modeling

- Establish continuous review and adjustment cycles

Technology enables this process, but managed services ensure it is sustained over time.

Conclusion

Transportation cost volatility is not inevitable. While markets will always fluctuate, their impact on budgets can be managed.

By shifting from static planning to a managed transportation model, organizations gain predictability, control, and confidence in their freight spend.

If volatility continues to undermine your freight budget, it may be time for a different approach. ODW Logistics helps shippers evaluate their current exposure and build a managed transportation strategy that stabilizes costs and supports long-term growth.

FAQs

What causes freight cost volatility?

Fuel prices, capacity shifts, seasonal demand, carrier rate changes, and global disruptions all contribute to fluctuating transportation costs.

How can companies stabilize transportation budgets?

Stability comes from proactive forecasting, diversified carrier strategies, dynamic planning, and continuous cost management rather than static annual budgeting.

How does managed transportation improve budgeting?

Managed transportation combines analytics, carrier management, and expert oversight to reduce variability and improve forecast accuracy over time.